1. European political agreements to launch the EU´s Secure Connectivity Programme

On November 17th, 2022, the Council and the European Parliament reached a provisional agreement on the Regulation establishing the EU’s space-based Secure Connectivity Programme for the period 2023-2027, aimed at deploying the Infrastructure for Resilience, Interconnectivity and Security by Satellite (IRIS2).[1] On November 22nd-23rd, 2022, ESA established a new optional Programme related to EU Secure Connectivity under its Telecommunications and Integrated Applications Directorate (TIA), during the ESA Council at the Ministerial Level (CM22).[2]

At the EU level, the provisional trilogue agreement (European Parliament, Council and European Commission)[3] has been consequently validated in the European Parliament Committee on Industry, Research and Energy (ITRE) on November 29th, 2022, and it is currently going through the formal steps of the adoption procedure.[4] The implementation of the programme will be based on an incremental approach, including the objective to deliver initial services in 2024 and reach full operational capability by 2027.[5] Implementing acts and tender specifications are being prepared by the European Commission.

Unlike Galileo and Copernicus, it is the first time that an operational EU space programme element is established within the context of an already existing and mature commercial market, with European operators already developing and serving a connectivity market that is forecasted to double between 2020 and 2030 to $20.6 billion.[6]

IRIS² can benefit from the expertise and world-renowned excellence of the European space industry in the telecommunications sector, integrating the know-how of commercially well-established industrial players, including manufacturers, technology providers and operators with the dynamism of an emerging new space ecosystem and new entrants., For the first time, such an operational programme has the ambition to ensure a minimum of 30% of the EU-funded component for start-ups and SMEs.[7] ESA ARTES is also already operating in that market since more than a decade, with an accumulated 2.2 billion industrial co-funding in public-private partnerships with European space industry.

The new element is conceived as a multi-orbital satellite constellation covering the full spectrum of needs for secure communication services to European governments by 2027. While the IRIS2 should prioritise the delivery of governmental services, it allows “for the provision of commercial services by the European private sector”.[8] The programme aims to improve secure connectivity over geographical areas of strategic interest, such as Africa and the Arctic. While the governmental part of the programme represents an evolution of the GOVSATCOM component of the EU Space Programme,[9] the commercial ambition of the programme can be seen as a major extension of the GOVSATCOM objectives, with the goal to further stimulate the competitiveness of the already existing market.

This represents a new challenge for all stakeholders in a public-private setting how to realise the synergies between government objectives of the EU stakeholders and the market objectives of industry and satellite operators in particular.

2. Who picks up the tab?

During the institutional meeting on November 17th, the major point of discussion between the European Parliament and the EU Council concerned the budget. The resulting agreement on the EU budget component represented a milestone with effects beyond the EU, also incentivising political agreements on investment in the newly established ESA optional Programme related to EU Secure Connectivity during the ESA CM22.

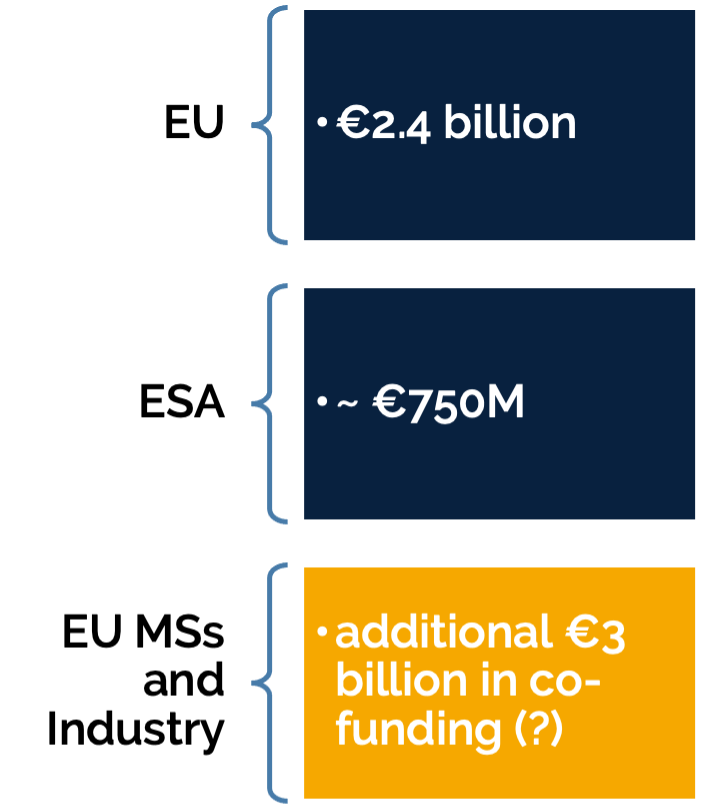

In the Impact Assessment Report accompanying the Proposal for a Regulation establishing the Union Secure Connectivity Programme in February 2022, the European Commission highlighted the budget assessment to design the Secure Connectivity space architecture. It provided an estimated cost associated with the development and deployment of the infrastructure of approximately €6 billion, including a blending of funds in the form of a public-private partnership (PPP) with €4 billion from the public sector (EU and Member States) and €2 billion from the private sector. [10]

Based on the impact assessment, the programme will provide economic benefits related to the deployment of a new infrastructure consisting of a GVA of €17-24 billion and additional jobs in the EU space industry, with further spill-over effects on the economy through downstream sectors using innovative connectivity services.[11] As such, the result of the return on investment from the Secure Connectivity Programme is expected to yield up to four times increase in revenue in terms of GVA.

As a result of the negotiations, the European Commission will cover €2.4 billion with funds from the EU Space Programme, Horizon Europe and the Neighbourhood Development and International Cooperation Instrument – Global Europe (NDICI).

The programme will be implemented in cooperation with ESA, which requested €750 million at CM22, and subsequently subscribing for approximately €650 million. This includes France which announced it has subscribed up to €300 million for IRIS², depending on the consortia that will be eligible;[12] and Germany and Spain with significant contributions, of approximately €145 million and €41.5 million respectively. The programme also leverages non-EU contributions from Norway and Switzerland.

As a key financial contributor, the European space industry is also expected to co-fund a significant share of the programme to reach the full financial requirements for the constellation. It would be critical for the success of the programme to incentivize private actors and allow to develop commercial services, which can take benefit of the public investment in governmental infrastructure and services.[13]

3. Governmental needs and commercial opportunities: challenges of a public-private symbiosis?

As previously highlighted, it is the first time that there is an ambition to develop an EU space programme within a mature commercial market, with the private sector called to significantly invest into the programme. IRIS2, therefore, needs to answer (perhaps for the first time in such set-up) a set of questions related to commercial contributions.

Based on the Regulation, IRIS2 shall consist of a governmental infrastructure and a commercial infrastructure. Governmental infrastructure “shall include all the related ground and space assets which are required for the provision of the governmental services”, while the commercial infrastructure “shall include all space and ground assets other than those being part of the governmental infrastructure without impairing its performance or security”.[14] Going into detail, the European Commission:

“Shall be the owner of tangible and intangible assets which form part the governmental infrastructure developed under this programme”, with EU-owned governmental infrastructure to be procured through public-private partnerships via competitively awarded contracts to industry (“hard gov”).[15]

Non-EU-owned commercial infrastructure will also be used to provide governmental services (“light gov”) under the IRIS2 umbrella.[16]

Furthermore, the programme “should allow for the provision of commercial services by the European private sector, through a commercial infrastructure”.[17]

The change in paradigm is that IRIS2 seek synergies with the business goals of private partners and vice versa. This requires innovative governance schemes, which must ensure that the programme is built on a symbiotic public-private partnership that would allow for the co-creation and operation of a programme/infrastructures while preserving the objectives of partners.

A critical element of the overall success of IRIS2 will be in the conditions under which commercial services can be provided by private actors through the IRIS2 commercial infrastructure and IRIS2 ability to boost entrepreneurial energies for the development of a new range of commercial services from Low Earth Orbit on that infrastructure. This may include services, which today are entering the market globally like for connectivity to handhelds or for mobile services to maritime, airlines and in support of autonomous driving. Provided that attractive conditions are negotiated between the partners, this could establish IRIS2 as a true catalyst for the development of new multibillion-euro markets, in synergy with the development of the institutional solution in response to EU requirements, but well beyond those EU institutional needs.

In this light, several satellite operators, including SES, Hispasat and Eutelsat have expressed their interest in contributing to the programme, however, subjecting it to certain conditions for its governance, funding, procurement and operations/service provisions. In particular, several satellite operators highlighted the need to play a more prominent role and to be on the front line in the definition of the mission, co-sharing the financial and technological risks, while also leading the procurement process with the manufacturers.[18]

The increasing interplay of commercial satellite providers in governmental security communication services has most recently also been demonstrated by Starshield: SpaceX´s newly created business segment plans to leverage the commercial LEO Starlink constellation to develop products and services to support the national security of government agencies in three areas, comprising communications, remote sensing and hosted payloads.[19]

4. Who gets to participate in the EU’s sovereignty programme?

IRIS² is planned to comprise a sovereign constellation for government services, which implies a series of strict eligibility criteria and security requirements to be defined by the EU for the manufacturing and operation of the constellation. Based on the proposal for the Regulation, those requirements should aim to “ensure the security of the EU and the Member States and to strengthen the resilience across key technologies and value chains”,[20] thus showing the increasingly prominent place of security in the European space policy agenda.

Already in June 2022, Iceland, Liechtenstein and Norway submitted a joint EEA EFTA Comment on the Commission’s proposed Regulation to suggest some amendments, to ensure full and efficient participation of EEA EFTA States based on the EEA Agreement.[21]

The EU programme will be carried out in cooperation with ESA under ESA procurement and project management rules. Indeed, at the ESA CM22, Director-General Josef Aschbacher distinguished between “hard” security element of the programme, and “soft”, more commercial, component that may allow for the participation of ESA’s non-EU Member States and private contributions.[22]

Additional concerns have been raised by a part of the space industry, especially Amazon’s Project Kuiper, Eutelsat (in the process to combine with UK-based OneWeb, see ESPI Brief 60) and Germany-based, but U.S.-financed, Rivada Space Networks, that risk being kept out of their involvement in the new EU programme.[23]

The ongoing combination between Eutelsat and OneWeb, and the UK government “Class B” share (which will remain at the level of OneWeb as a subsidiary of future Eutelsat),[24] raised questions on how the EU will reconcile its security requirements (and stricter control) with the ever-increasing role of private actors, so to foster a flourishing commercial ecosystem.[25] In particular, the Eutelsat and OneWeb multiorbital system, in perspective of the deployment of the Gen-2 constellation, might be a candidate for and be a part of the EU’s Secure Connectivity solution, also creating and then leveraging synergies in terms of schedule, co-funding stimulation, key technologies and coordination of spectrum.

Nevertheless, Commissioner Thierry Breton declared that OneWeb’s UK pedigree will make it incompatible with the EU Secure Connectivity Programme. Successively, Christophe Grudler, Rapporteur of the ITRE Committee of the European Parliament claimed that: “the EU needs to have full control over its satellites without a risk of hindrance by an outside actor” and that “the EU cannot accept a UK veto on a secure connectivity infrastructure”, ruling out the combined company as a likely qualifying candidate.[26] However, in September 2022, the ITRE Rapporteur specified after a work session with Eutelsat CEO, Eva Berneke, that Eutelsat can compete in the Secure Connectivity programme like all the other players, in strict compliance with EU eligibility rules.[27]

On its end, the European Parliament Report on the Regulation Proposal states that “the Programme should, where appropriate, be open to participation of third countries (…)” and that “the Commission shall ensure control over the infrastructure shared with the private partner, thereof contractual provisions shall be considered in the concession agreement such as buy-back option in case of default, veto right in case of acquisition by a third country company and vetting of key personnel”.[28]

European stakeholders should continue to evaluate whether and on which terms the EU may benefit from the options already present on the European market, in terms of engineering, operations, access to space, and availability of spectrum. The framework to be developed should be mindful of establishing requirements that would disincentivise a true catalysation of the commercial market or which could discourage commercial actors and new entrepreneurs to engage and invest.

5. From theory to practice: towards an “open” European strategic autonomy

After Galileo and Copernicus, the inclusion of an additional space component to the European portfolio of strategic space infrastructures is a representation of the European ambition to safeguard key communications services and reduce the dependence on international public and private actors, responding to the exceedingly present security challenges.

On the other hand, more than ever before, the EU, and Europe at large, has the opportunity to leverage the profound transformation of its space sector, and be a catalyst of new commercial services “Made in Europe”. This will require a European approach to public-private relationships, catalysing existing and evolving commercial markets in the spirit of European strategic autonomy, open to a European solution and to private European actors, while safeguarding EU strategic interest.

An institutionally centric approach like for Galileo and Copernicus, In the case of IRIS2 would come with non-negligible risks to the long-term success and a commercially sustainable competitive European space ecosystem.

____________________________________

[1] Council of the EU, Council and European Parliament agree on boosting secure communications with a new satellite system (Link)

[3] See European Parliament, REPORT on the proposal for a regulation of the EP and of the Council establishing the EU Secure Connectivity Programme for the period 2023-2027 (Link)

[4] EP, ITRE 28-29/11: Energy crisis, secure connectivity, critical technologies (Link)

[5] European Commission, IRIS²: the new EU Secure Satellite Constellation (Link)

[6] Euroconsult, Satellite Connectivity and Video Market Report (Link)

[7] EPP, Deal on new EU satellite telecommunications programme (Link)

[8] Council of the EU, Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing the Union Secure Connectivity Programme for the period 2023-2027 – Letter to the Chair of the ITRE Committee of the European Parliament (November 2022) (Link)

[9] European Commission, Welcome to IRIS² (Link)

[10] European Commission, Executive Summary of the Impact Assessment Report (Link)

[11] European Commission, Executive Summary of the Impact Assessment Report (Link)

[12] French Government, Press room (Link)

[13] Twitter, Peter B. de Selding (Link)

[14] Council of the EU, Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing the Union Secure Connectivity Programme for the period 2023-2027 – Letter to the Chair of the ITRE Committee of the European Parliament (November 2022) (Link)

[15] Council of the EU, Proposal for a Regulation establishing the Union Secure Connectivity Programme for the period 2023-2027 – Letter to the Chair of the ITRE Committee of the European Parliament (November 2022)

[16] Council of the EU, Secure space-based connectivity: Council adopts negotiating mandate (Link)

[17] Council of the EU, letter to the Chair of the ITRE Committee of the European Parliament (Link)

[18] Space Intel Report, Satellite operators Hispasat, SES to European Commission: We’ll invest in your constellation if we can run it on our terms (Link)

[19] SpaceX, Starshield (Link)

[20] European Parliament, REPORT on the proposal for a regulation of the EP and of the Council establishing the EU Secure Connectivity Programme for the period 2023-2027 (Link)

[21] EFTA, EEA EFTA Comment on the proposal for Union Secure Connectivity Programme (Link)

[22] Space Intel Report, EU Commission to ESA: Keep non-EU-sourced critical components out of connectivity, navigation & Copernicus missions (Link)

[23] Space Intel Report, Mega-constellations Amazon Project Kuiper, Eutelsat OneWeb, Rivada Space Networks pitch their European bona fide (Link)

[24] UK, OneWeb merger with Eutelsat (Link); and Space Intel Report, With Eutelsat OneWeb investment, UK government’s ‘golden share’ has new meaning (Link)

[25] Euronews, Europe’s space sector hesitates between independence and cooperation (Link)

[26] Bloomberg, France and UK Try to Put Brexit Behind Them – In Space (July 2022) (Link)

[27]Christophe GRUDLE, Twitter (September 2022) (Link)

[28] European Parliament, REPORT on the proposal for a regulation of the European Parliament and of the Council establishing the Union Secure Connectivity Programme for the period 2023-2027 (Link)