Last week, we have released the 2022 edition of Space Venture Europe, our annual report on private investment in the space sector focusing on investment data for European, global, and Chinese markets.

Here are the five key takeaways from the report:

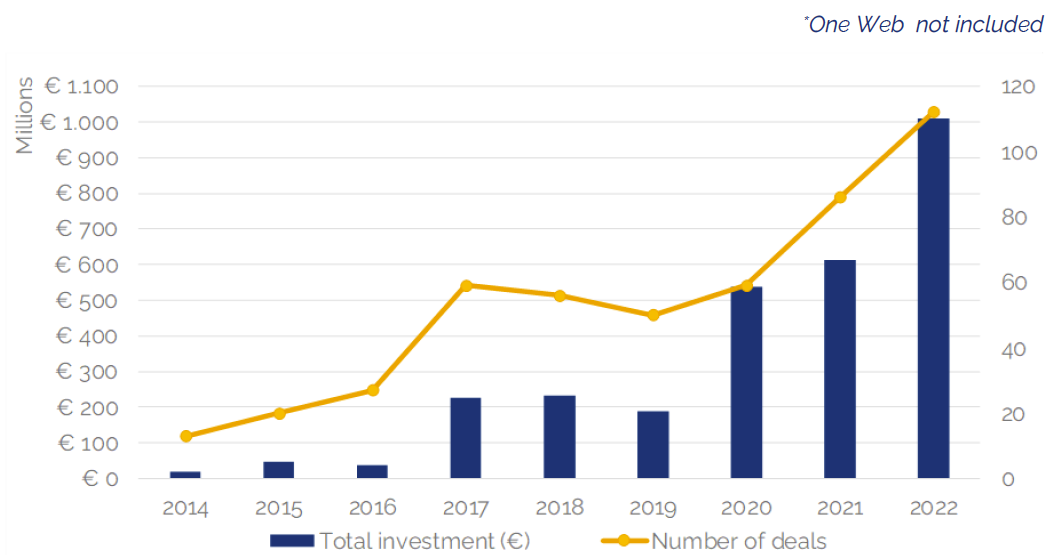

1) Another record-breaking year for Europe with €1,1 billion distributed across an all-time high of 112 deals

After a period of stagnation with investments plateauing at around €200 million per year from 2017 to 2019, 2022 solidified the accelerated growth trend that began in 2020.

Investment value and number of deals per year 2014-2021 (Europe)

The graph clearly indicates a massive growth since 2014 (CAGR-45%) in Europe, with annual investment growing from €50 million to €1 billion million in just 8 years. The growth of investment into European New Space is even more striking when realising that 2022 alone represents significantly more than the total invested from 2014 to 2019.

The top 5 deals recorded in 2022 included ICEYE (€119.5 million), Celestia Aerospace (€100 million), Mangata Networks (€95 million), Kongsberg NanoAvionics (€50 million) and E-Space (€46.7 million).

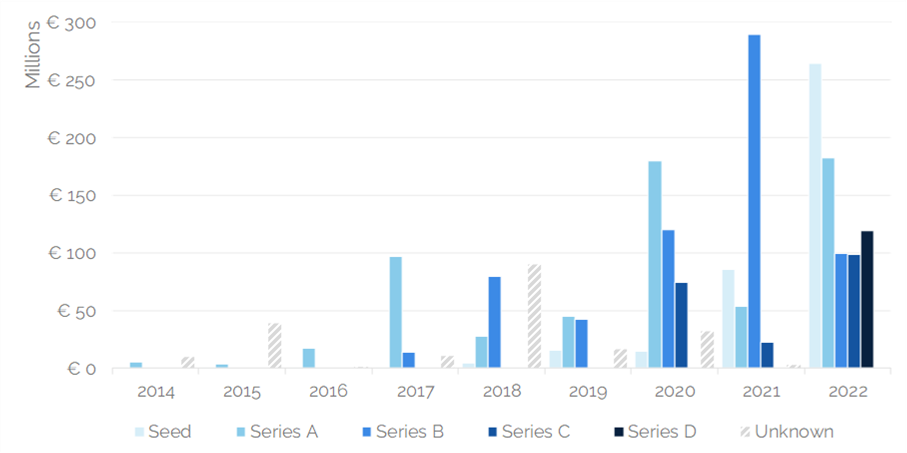

2) Significant increase in both volume and value of late-stage VC rounds

Yearly volume of Venture Capital investments by round from 2014-2022

Venture Capital (VC) played a dominant role in funding European space start-ups during the 2014-2022 period, accounting for a substantial 76% of the total investments. While seed rounds represented the largest VC round in both number and combined value in 2022, the year has also seen four Series C rounds, compared to just one in each of 2020 and 2021, as well as the first-ever Series D round in European space start-ups. The upward trend in late-stage funding is complemented by a diversification of companies receiving the investments.

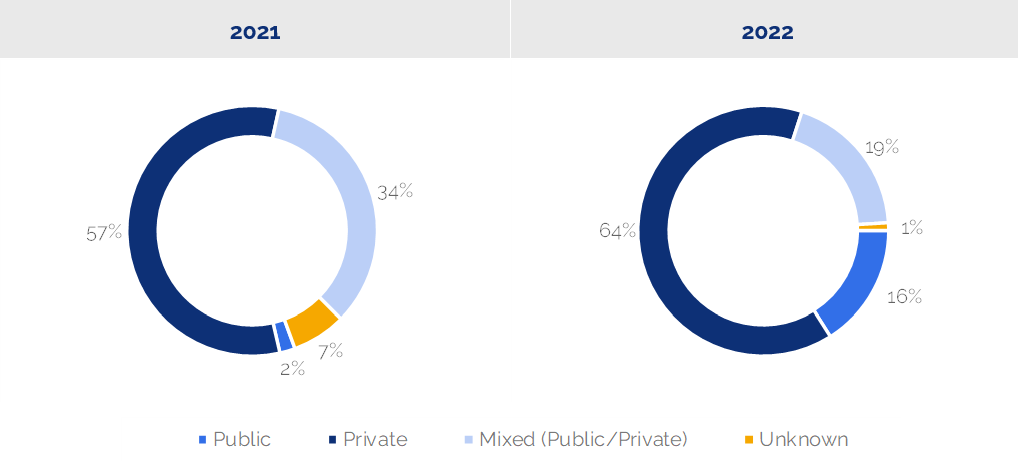

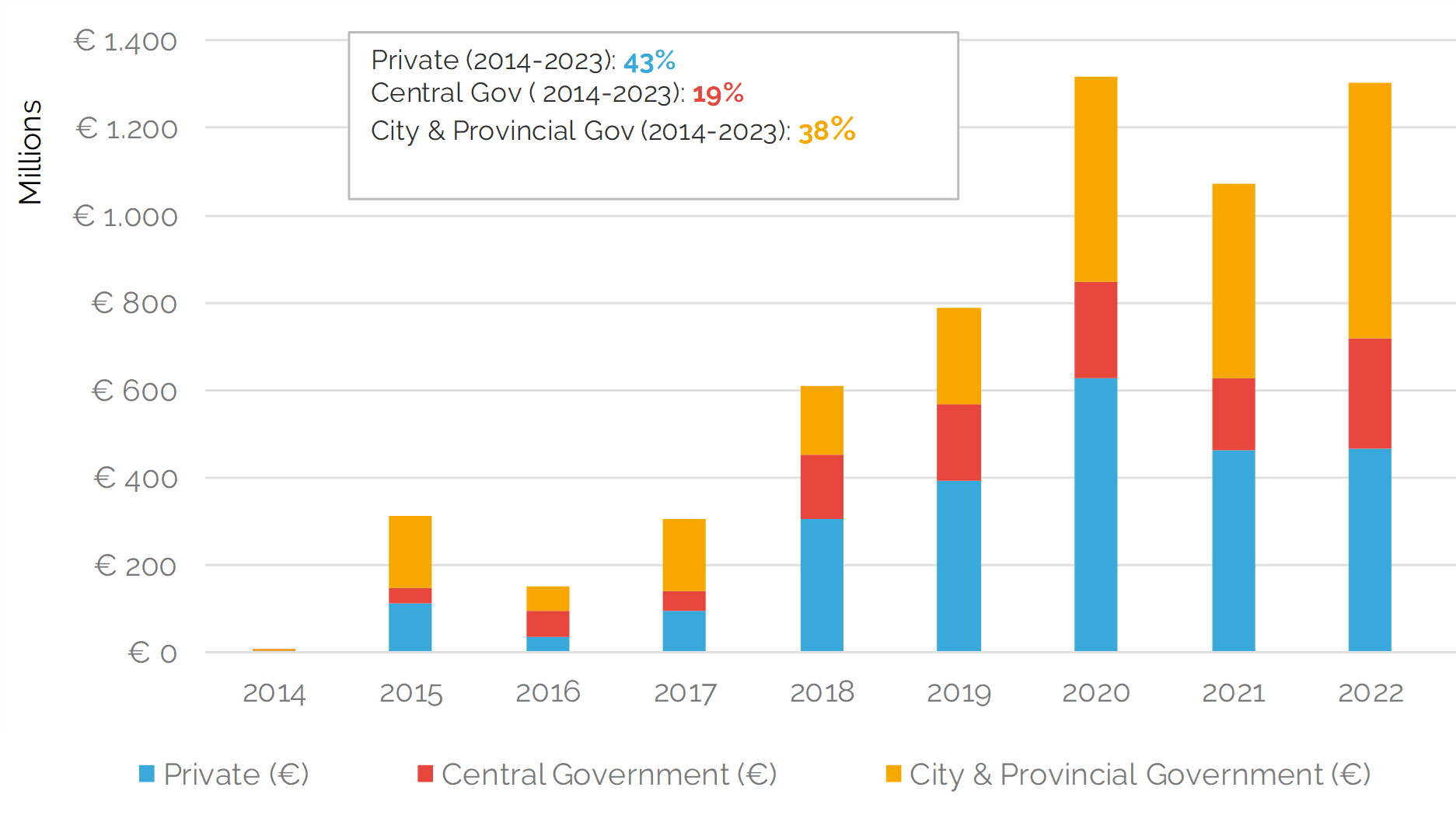

3) Growth in support from public institutions

Public support to New Space Investments in Europe

Public institutions are showing their ambition in having a progressively more prominent role in supporting the growth and development of the European space start-up ecosystem. The primary element to be highlighted in 2022 is the growth in direct public investments ( i.e., where the lead investor is a recognized public investment institution). ESPI tracked a total of 14 led public investment deals out of which the main investment type used has been debt financing.

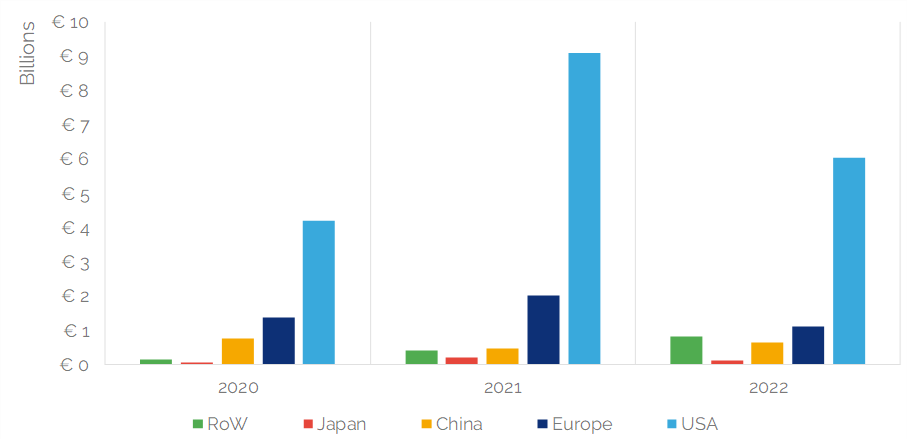

4) U.S. ecosystem is still dominant in the global investment landscape followed by Europe and China

Investment volume per region

Global investment in space ventures in 2022 totalled €8.8 billion, which represents a 28% decline from the previous year’s peak of €12.2 billion. However, it is important to note that 2021 was an exceptional year and should be seen as an outlier. The difference in volume between 2021 and 2021 can be almost entirely attributed to the lack of SPACs. Outside of the United States, European countries, China, and Japan, the total investment in space in the rest of the World has increased from €24 million in 2019 to €837 million in 2022 (majority originating from Canada, India, Israel and Australia). This represents an incredible 3379% growth over three years.

5) Remarkable growth in investment in China’s space sector, with over ¥50 billion (€6.5 billion) raised by more than 100 companies since 2014.

This year’s edition of “Space Venture Europe” once again opens new horizons, as it includes a special focus on China, managed by Orbital Gateway Consulting founder Blaine Curcio.

Origin of New Space investment in China ( source Orbital Gateway Consulting)

While still largely dominated by state-owned enterprises, an increasing number of commercial companies have entered the sector. The Chinese commercial space sector has attracted significant funding, with the launch sector receiving the largest share of investments, accounting for nearly 40% of the total amount.